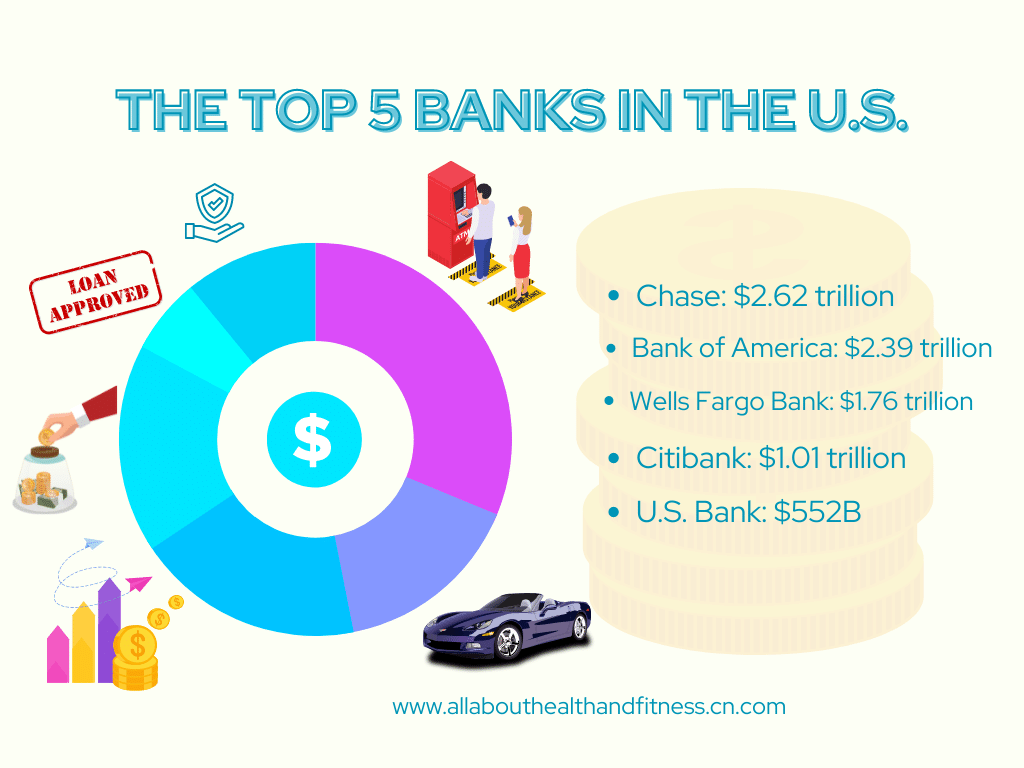

The top 5 banks in the U.S.

Putting your money with a large bank usually means you’ll have more access to in-person services at branches, a large ATM network, and a diverse range of products and services, which can be convenient if you want to do all of your banking in one place.

We looked at the domestic asset sizes of institutions that serve both consumers and small businesses to determine the largest banks in the United States.

Retail banks for personal banking are included on the list, rather than investment banks.

The value of a bank’s assets include, for example, the amount of loans, mortgages, and credit card accounts.

Some of these banks have thousands of branches, while others operate primarily — or entirely — online.

These banks are all FDIC-insured.

The largest banks in the United States, according to NerdWallet.

JPMorgan Chase & Co. includes Chase, the largest bank for consumers and small businesses.

It has one of the most extensive branch networks of any major bank, with locations in the majority of states.

- ATMs: 16,000.

- More than 4,700 branches in 48 states and Washington, D.C., with a heavy concentration in California, the East Coast, and Texas; no branches in Alaska or Hawaii.

Bank of America (2.39 trillion dollars)

Bank of America is the second-largest bank, with branches in the second-most states. It has the fewest branches but the most ATMs of the top three banks on this list.

- There are approximately 16,000 ATMs.

- About 4,100 branches in 37 states and Washington, D.C., with the majority concentrated in California, the East Coast, and Texas.

1.76 trillion for Wells Fargo Bank

The bank with the most locations is Wells Fargo. However, of the top three largest banks, Wells Fargo has the fewest ATMs.

- There are over 12,000 ATMs.

- Branches: There are approximately 4,900 branches in 36 states and Washington, D.C., with high concentrations in California, Florida, and Texas.

Citibank ($1.01 trillion)

Citibank has one of the fewest bank branches on this list, but it does have a massive domestic ATM network.

- There are over 65,000 ATMs, including those in the Allpoint and MoneyPass networks.

- More than 650 branches are spread across 11 states and Washington, D.C., with a heavy concentration in California and New York.

U.S. Bank: $552 billion

U.S. Bank has thousands of ATMs and roughly half the number of branches as the top three banks on this list.

- There are over 37,000 ATMs, including those in the MoneyPass network.

- There are approximately 2,300 branches in 28 states, with high concentrations in California, Illinois, and Ohio.